Table of Content

During that period, Mary owned the house all 5 years and lived in it as her main home from August 2, 2007, until August 28, 2009, a period of more than 24 months. She meets the ownership and use tests because she owned and lived in the home for at least 2 years during this test period. Unfortunately, you can't claim a foreign tax credit based on any gains you excluded under the provisions of Internal Revenue Code Section 121—the $250,000 or $500,000 exclusions for the sale of your personal residence. The U.S. taxes you on any income you earn, whether it's earned in the U.S. or another country. So if you owned a home or property in another country, and then sold that home for a profit, you'll need to report the sale just as you would if it were located in the U.S. When you sell your home or when you are considered to have sold it, usually you do not have to pay tax on any gain from the sale because of the principal residence exemption.

Go to IRS.gov/Form1040X for information and updates. Go to IRS.gov/Forms to view, download, or print all of the forms, instructions, and publications you may need. Or, you can go to IRS.gov/OrderForms to place an order.

Some profit on a home sale can be tax-free

Businesses and any other parties involved in a real estate transaction must issue an IRS Form 1099-S to anyone who receives at least $600 during the year. The same rules apply if the property was inherited and considered a personal capital asset. This is for individuals who received a 1099-S because of the sale of their primary residence.

Use a separate Part II for each type of long-term transaction described in the text for one of the boxes at the top of Part II. Include on each Part II only transactions described in the text for the box you check . Check only one box on each Part II. For example, if you check box D in one Part II, include on that Part II only long-term transactions reported to you on a statement showing basis was reported to the IRS. Complete as many copies of Part II as you need to report all transactions of each type .

Gains and Losses on the Sale of Real Estate/Property

Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income. Use Schedule D , Capital Gains and Losses and Form 8949, Sales and Other Dispositions of Capital Assets when required to report the home sale. Refer to Publication 523 for the rules on reporting your sale on your income tax return. For the year in which you sold a foreign property, you have to report the proceeds as income on your tax return using Form 8949, for the Sales and Other Dispositions of Capital Assets. You'll also need to fill out Schedule D to fill in the capital gains and losses portion of Form 1040. The Internal Revenue Code provides certain exclusions if the property actually served as your main home.

To figure the overall gain from transactions reported on Form 8949. Sale of stock of a specified 10%-owned foreign corporation, adjusted for the dividends-received deduction under section 245A, but only if the sale would otherwise generate a loss. The election to defer capital gain invested in a qualified opportunity fund . Other gains where sales price or basis isn't known. Seller costs, Costs owed by the seller that you paid.Settlement fees, Fees and Closing CostsSpouseDeath of Surviving spouseBasis determination, Surviving spouse. LITCs represent individuals whose income is below a certain level and need to resolve tax problems with the IRS, such as audits, appeals, and tax collection disputes.

Business or rental use

DON’T follow the instructions at the end of line 7, under Worksheet 2. Instead, report the gain from your “Business” worksheet on Form 4797. Space that was once used for business or rental purposes may be considered as residence space at the time of sale. A space formerly used for business is considered residence space if ALL of the following are true. You can’t deduct this loss, but you don’t need to pay any tax on the money you received from selling your home.

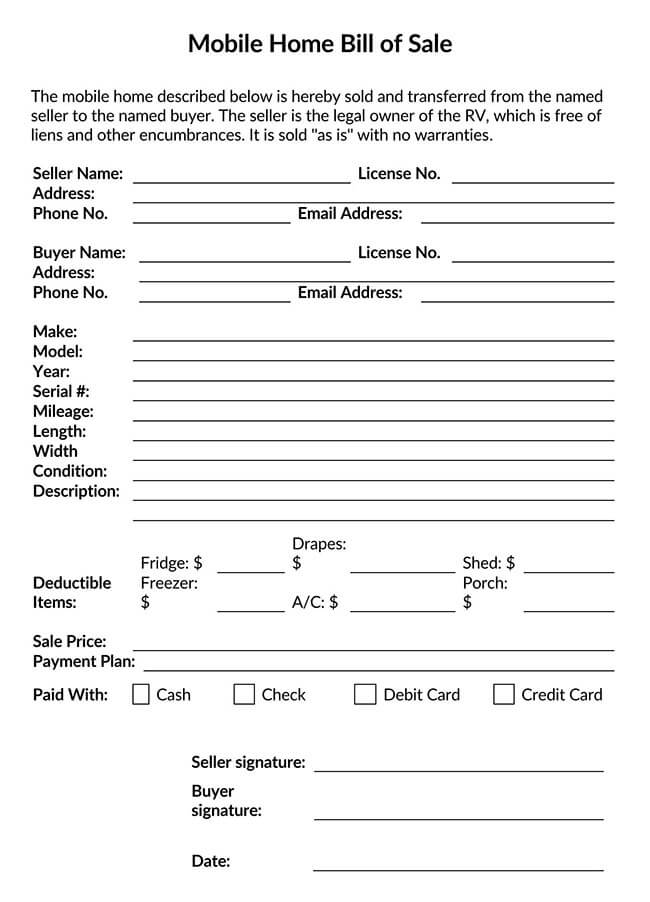

However, if you move your home from the land on which it stood , then that land no longer counts as part of your home. For example, if you move a mobile home to a new lot and sell the old lot, then you can’t treat the sale of the old lot as the sale of your home. You can include the sale of vacant land adjacent to the land on which your home sits as part of a sale of your home if ALL of the following are true. Also, you may be able to increase your exclusion amount from $250,000 to $500,000.

Do you have to pay taxes on the gains reported on the IRS Form 1099-S?

The value of the investment may fall as well as rise and investors may get back less than they invested. Filling out Form 8949 may take a little time, but it isn’t a complex form to fill out. If you have stocks, your broker’s 1099 should provide all of the necessary information. If you are selling a home, finding the cost basis is a little more involved. If the FMV of the property at the time the donor made the gift is less than the donor's adjusted basis, your adjusted basis depends on whether you have a gain or loss when you dispose of the property. The basis of stocks or bonds you own generally is the purchase price plus the costs of purchase, such as commissions and recording or transfer fees.

Escrow agent refuses to correct the number of transferors with allocation changes on the substitute form 1099s when she was informed of mistake after escrow closing which prejudices my tax return by concealing information. As you navigate this process, be sure to consult a real estate tax attorney or accountant if you need help getting everything in order. For example, if the sale was for less than $600 , or if the transaction was closed without a title company or closing attorney and you agreed to be responsible for reporting the sale.

If the house was your principal residence, and you lived inand owned the house for at least 24 out of the last 60 months ending on the date of the sale, you can exclude $250,000 of capital gains from taxation. This amount increases to $500,000 in capital gains if you're married and you and your spouse file a joint return. According to the Internal Revenue Service, you might not have to pay taxes on the sale of your home at all, thanks to capital gains tax exclusions. (More on that later.) However, if you don’t qualify for capital gains tax exclusions, your home sale will be reported to the IRS through a 1099-S form.

Had no sale or exchange of another principal residence during the 2-year period ending on the date of the sale or exchange of the residence. Owned and used as the principal residence for 2+ years of the 5-year period ending on the date of the sale or exchange of the residence. Code H, which you enter in Column F and report the excludable gain as a negative number in Column G, if you're reporting the sale of your main home and can exclude some or all of the gain. Code T, which you enter in Column F and also enter zero in Column G, if you received a Form 1099-B and the gain or loss shown is incorrect. It’s best to work with a tax accountant to determine your property’s cost basis. If you're a member of a dividend reinvestment plan that lets you buy more stock at a price less than its FMV, you must also report as dividend income the FMV of the additional stock on the dividend payment date.

David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. Enter the amount of exclusion allocated inExclusion (-1 to recognize full gain). Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. For a full schedule of Emerald Card fees, see your Cardholder Agreement.

Professional golfer taxes can be complicated and confusing. Learn more about tricky golfer tax issues like travel deductions and residency rules with H&R Block. However, you can’t exclude the part of the gain equal to any depreciation allowed or allowable after May 6, 1997. Periods of nonqualified use after Dec. 31, 2008, will also reduce the amount you can exclude. Change homes if a doctor recommends a change of residence. This could be due to an issue in getting or providing medical or personal care for the suffering person.

Do I have to pay U.S. taxes if I sell a foreign property that I inherited?

The address for the property involved in the transaction is also needed, as well as the gross amount of proceeds received from this real estate transaction. The 1099-S form should be submitted with the rest of the year's tax documents. Do not report the sale of your primary residence on your tax return unless your gains exceeded your exclusion amount.

No comments:

Post a Comment